Homeowners Insurance in and around Beaverton

Homeowners of Beaverton, State Farm has you covered

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Being a homeowner comes with plenty of worries. You want to make sure your home and the possessions in it are protected in the event of some unexpected damage or loss. And you also want to be sure you have liability insurance in case someone gets hurt on your property.

Homeowners of Beaverton, State Farm has you covered

The key to great homeowners insurance.

Agent Chris Gonzales, At Your Service

Navigating the unexpected is made easy with State Farm. Here you can create a plan that's right for you or file a claim with the help of agent Chris Gonzales. Chris Gonzales will make sure you get the thoughtful, excellent care that you and your home needs.

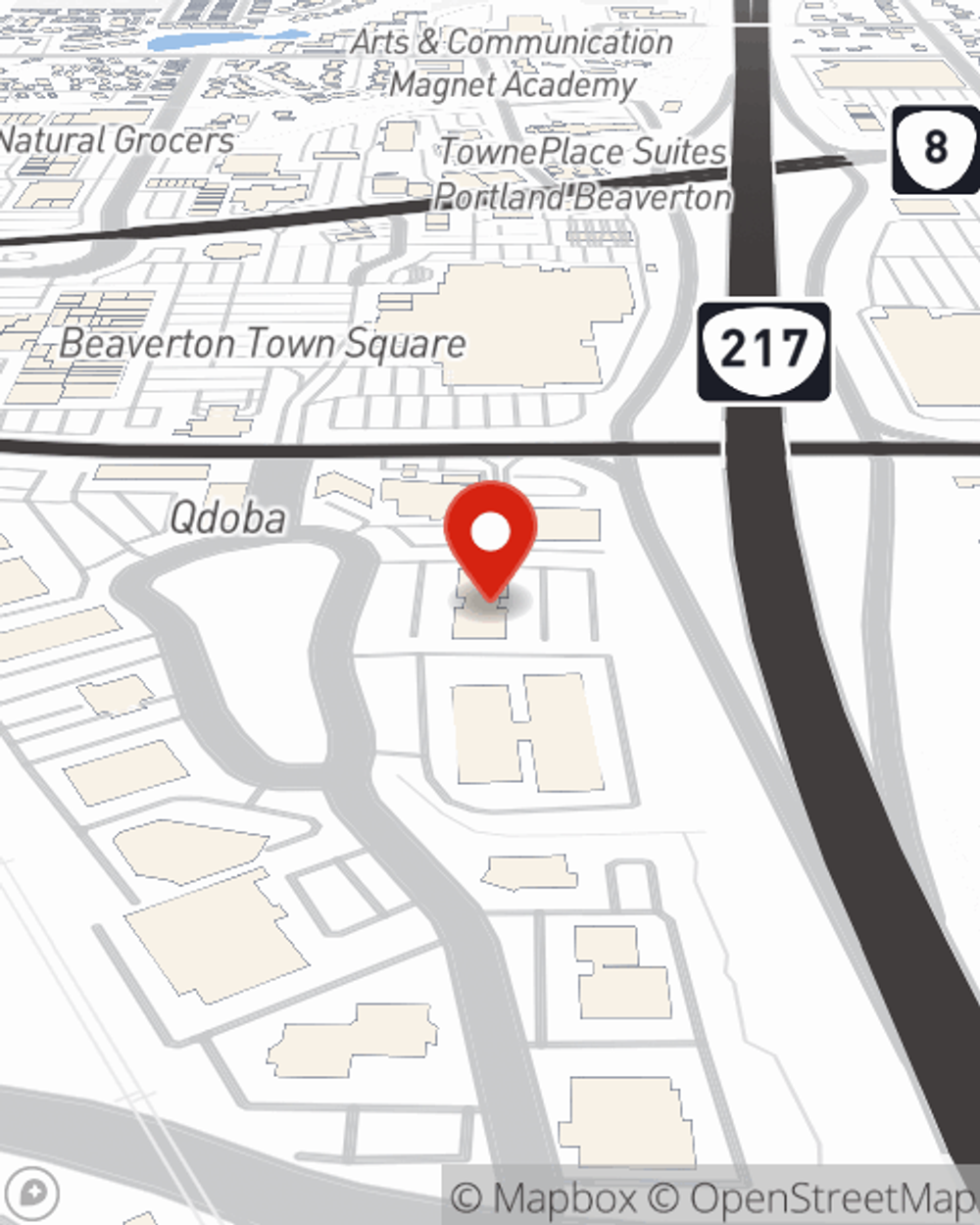

Contact State Farm Agent Chris Gonzales today to see how a well known name for homeowners insurance can help protect your house here in Beaverton, OR.

Have More Questions About Homeowners Insurance?

Call Chris at (503) 646-4240 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Collectibles insurance and appraisal tips

Collectibles insurance and appraisal tips

Follow these steps and have a collection appraisal to make sure you have the right amount of collectibles insurance.

Chris Gonzales

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Collectibles insurance and appraisal tips

Collectibles insurance and appraisal tips

Follow these steps and have a collection appraisal to make sure you have the right amount of collectibles insurance.